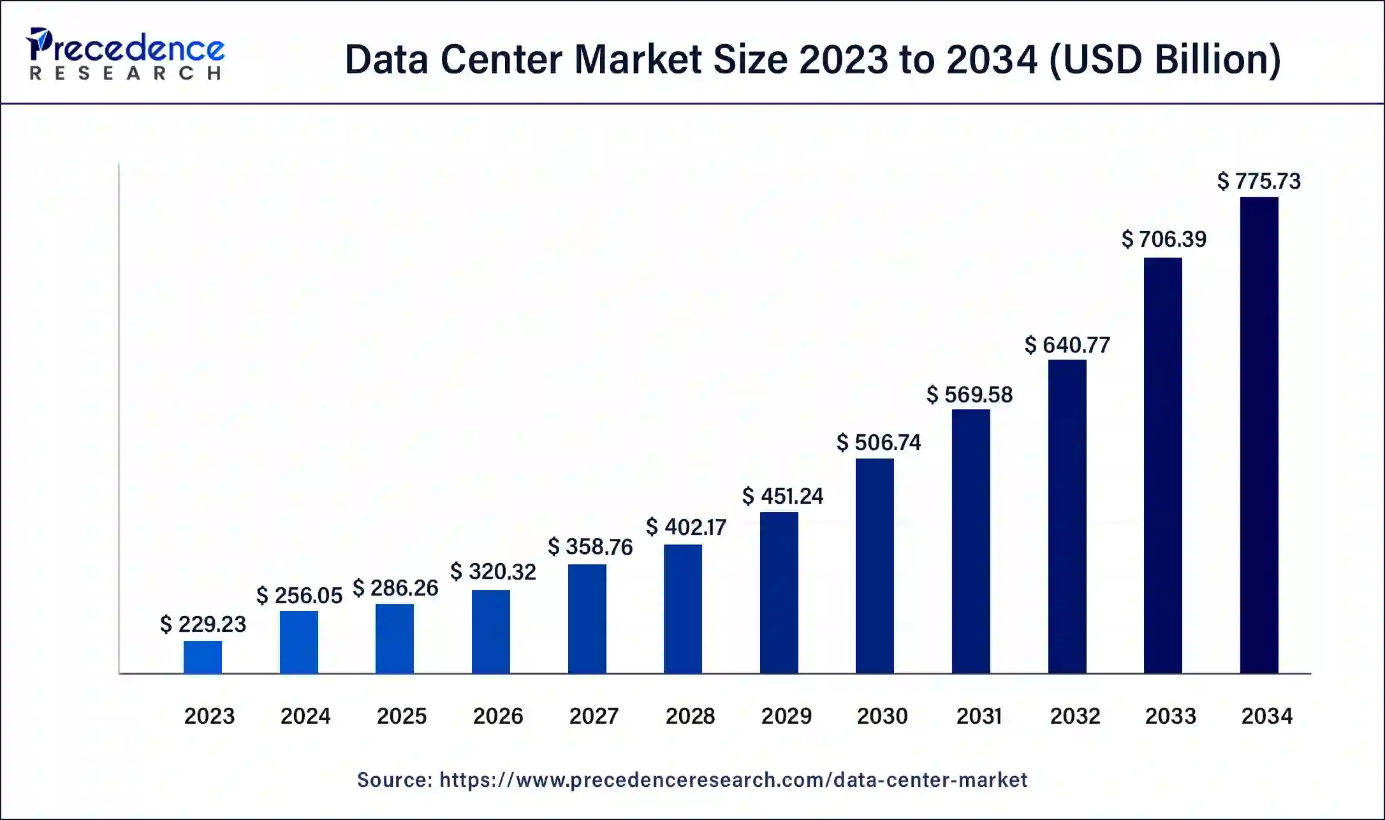

Data Center Market Size Expected to Reach USD 775.73 Billion by 2034

Ottawa, Sept. 18, 2024 (GLOBE NEWSWIRE) -- The global data center market size is predicted to increase from USD 229.23 billion in 2023 to approximately USD 775.73 billion by 2034, According to Precedence Research. The market is projected to grow at a double-digit CAGR of 11.72% between 2024 and 2034. The data center market is driven by increased usage of cloud computing technology and the need for data storage.

Data Center Market Overview

Data center refers to the industry that includes facilities, services, and infrastructure needed to store, handle, and process large amounts of data. Big data, eCommerce, cloud computing, IoT, and digital content are being increasingly used, influencing the demand for data centers. Multi-tenant data centers are required to host software and process and store data.

The Complete Study is Now Available for Immediate Access | Download the Sample Pages of this Report@ https://www.precedenceresearch.com/sample/3531

Additionally, digital platforms and services require robust data center infrastructure. Moreover, the stringent data privacy and security regulations necessitate investments in data center solutions. The market is expected to expand at a significant growth rate in the near future due to the rising usage of digital services and advanced technologies among businesses.

Data Center Market Highlights

- North America dominated the market with the largest market share of 38% in 2023.

- Asia Pacific is expected to witness the fastest growth during the forecast period.

- By component, the solution segment generated the biggest market share of 68% in 2023.

- By component, the services segment is projected to expand at a solid CAGR of 15.1% from 2024 to 2034.

- By type, the colocation segment contributed more than 42% of market share in 2023.

- By type, the hyperscale segment is expected to grow rapidly during the forecast period.

- By enterprise size, the large enterprises segment accounted for the highest market share of 72% in 2023.

- By enterprise, the small and medium enterprises (SMEs) segment is anticipated to witness the fastest growth throughout the studied period.

- By end user, the BFSI segment captured the biggest market share of 37% in 2023.

- By end-user, the IT & telecom segment is anticipated to grow at the fastest rate from 2024 to 2034.

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 8044 419 344

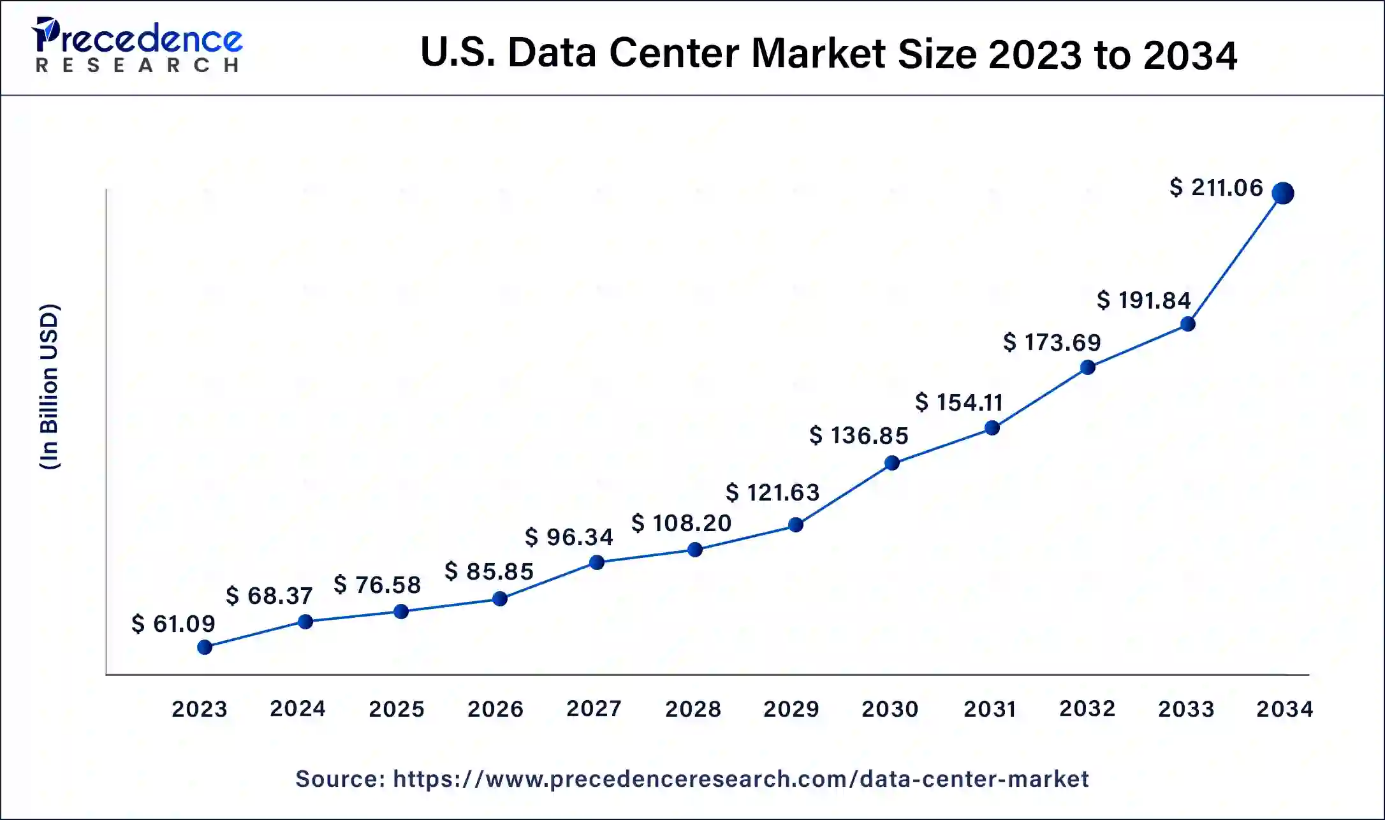

U.S. Data Center Market Size and Forecast 2024 to 2034

The U.S. data center market size was USD 61.09 billion in 2023 and is expected to grow from USD 68.37 billion in 2024 to USD 211.06 billion by 2034, registering a double-digit CAGR of 11.93% from 2024 to 2034.

Data Center Market Regional Outlook:

North America dominated the global data center market in 2023.

The construction of hyperscale data centers increased over the years due to the heightened demand for cloud services. Moreover, edge computing and hybrid cloud solutions gained immense traction, demonstrating the strong need for efficient data processing infrastructures to support the evolving digital landscape. Additionally, the proliferation of IoT and big data analytics and the high usage of advanced technologies contributed to regional market growth.

- In September 2024, Meta Platforms announced a plan to build a new data center campus to manage AI workloads in South Carolina, U.S.

Asia Pacific is expected to witness the fastest growth during the forecast period.

The region's market growth is attributed to the transition toward prefabricated and modular data centers to address the need for scalability. Moreover, the rising adoption of advanced technologies, like edge computing and Artificial Intelligence, and the rising digitization in various industries boost the need for data storage, thus boosting the market.

- In September 2024, Blackstone announced that it will buy Australian data center company AirTrunk for more than A$24 billion, representing its largest investment in Asia Pacific.

Data Center Market Scope

| Report Attribute | Details |

| Market Size in 2024 | USD 256.05 Billion |

| Market Size by 2034 | USD 775.73 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 11.72% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Component, Type, Enterprise Size, End User, and Region |

| By Component | Solution and Services |

| By Type | Colocation, Hyperscale, Edge and Others |

| By Enterprise Size | Large Enterprises and Small & Medium Enterprises (SMEs) |

| By End User | BFSI, IT & Telecom, Government, Energy & Utilities and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Data Center Market Segment Analysis:

Component Analysis:

The solution segment dominated the market in 2023, accounting for the largest market share.

Data center solutions involve setting up and maintaining certain racks within a data center. These solutions are used to erect and administrate a data center, such as IT hardware and supporting infrastructure. They also provide support for virtualized networks and security for data centers, which makes it possible to access cloud data through virtualized networks since much of data and infrastructure has become virtualized. The rising demand for automation solutions further contributed to the segmental growth.

- In June 2024, ESDS Software Solutions is set to establish two data centers in Noida and Kolkata in the next two years. It also aims to expand its existing centers in Bangalore and Mumbai.

The services segment is anticipated to expand at a significant growth rate in the coming years due to the increasing adoption of cloud services among businesses. Data center services provide information technology organizations with data backup, recovery, networking, and web hosting.

Managed service providers (MSPs) and colocation centers offer cloud data center services. These services are digitally managed so that an organization’s IT framework continues functioning smoothly without disruptions. In addition to this, IT teams take care of many parts of a data center ecosystem, ranging from computer system functioning, networking patterns, applications running on servers or any other related security concerns, and storage memory devices.

Type Analysis:

The colocation segment led the data center market in 2023.

Colocation data centers allow businesses to rent data center infrastructure from third parties. This option appeals to large businesses with a wide geographic presence, as it offers better reliability. Benefits of colocation data centers include fewer technical staff, excellent reliability, easy scalability, and lower cost, which make them affordable and trustworthy.

- In April 2024, under an AU$37 million arrangement, the Reserve Bank of Australia plans to move its Sydney head office’s data center into a CDC Data Centres colocation facility.

The hyperscale segment is expected to witness the fastest growth during the forecast period.

A hyperscale data center refers to a huge, highly tuned networking structure that serves big data loads that ensure good connectivity and low latencies. Due to its wide-ranging capabilities to scale up, it is increasingly used in organizations for various purposes, such as data storage, artificial intelligence (AI), automation, data processing, and data analytics. The increasing construction of hyperscale data centers is expected to boost the segment growth.

- In July 2024, Colt DCS plans to establish a large hyperscale data center on a 15-acre land in Airoli, Navi Mumbai.

Enterprises Analysis:

The large enterprises segment dominated the data center market in 2023.

In the realm of the data center industry, sizable enterprises need extensive IT infrastructure that entails intricate network architectures, data processing facilities, and storage capacities. Hyperscale data centers have become more popular among businesses for cloud computing, big data analytics, and digital transformation owing to their scalability, security, and efficiency. However, these three aspects are typically accorded the highest priority. Moreover, large enterprises often handle a large amount of data from various sources, boosting the need for data storage.

The small and medium enterprises (SMEs) segment is anticipated to witness the fastest growth throughout the studied period.

A large number of small and medium-sized enterprises (SMEs) are adopting colocation services as well as modular data center solutions for greater flexibility and cost efficiency. These enterprises are increasingly focusing on improving their digital capacities as they embrace the digitalization process. The rising adoption of cloud services among SMEs further contribute to segmental growth.

End User Analysis:

The BFSI segment dominated the global data center market in 2023.

The increasing trend of digital transactions bolstered the segment. The proliferation of internet of things (IoT) is reshaping the finance industry. Increased demand for data storage and adoption of cloud services among the BFSI industry contributed to the segmental growth. Moreover, finance businesses are increasingly installing distributed IT systems, edge computing platforms, hybrid cloud solutions, and micro data centers, thus boosting the need for efficient data center solutions.

- In February 2024, in order to improve AI-powered services, KakaoBank, a well-known mobile bank in Korea, partnered with Digital Realty to set up an artificial intelligence lab at its ICN10 data center.

The IT & telecom segment is projected to grow at the fastest rate in the near future.

The telecom and IT sectors are developing resilient infrastructures in response to increasing demand for digital services and data storage. The rising adoption of edge computing technology, 5G network deployment, and modular data center solutions in these sectors boost the segment. Businesses in these sectors seek pliable infrastructures with quick data processing times and greater capacity while offering better network performance at low latencies.

Data Center Market Dynamics:

Driver:

Increased adoption of IoT

As the adoption of the Internet of Things (IoT) increases among industries, the need for data centers also increases. IoT devices generate huge amounts of data that require adequate infrastructure to manage and store data. This encourages industries to invest heavily in constructing new data centers and retrofitting existing facilities to incorporate the latest industry standards. Automotive and healthcare are some of those industries which these gadgets have influenced. However, network infrastructure, as well as data management, has been instrumental in facilitating IoT operations.

Restraint:

Excessive energy consumption

Data centers require the largest amounts of power to run and cool down servers that handle cloud services, digital transactions, and information storage. Moreover, they often rely on non-renewable energy sources, thus contributing to carbon emissions. Data centers account for 0.8% of global electricity consumption, and their associated carbon footprint is about 0.3%, thereby raising concerns about their environmental impact.

Opportunity:

Leveraging AI and ML for market growth

The emergence of AI and machine learning (ML) is expected to revolutionize data center management. AI can organize, manage, and retrieve information, as it has the ability to analyze vast amounts of data. This also enables predictive maintenance and identifies anomalies. AI and ML help data centers provide real-time data processing. They also streamline resource allocations, thereby reducing the need for human intervention.

Browse More Insights:

- Hyperscale Data Center Market: The global hyperscale data center market size was estimated at USD 80.16 billion in 2022 and is expected to hit around USD 935.3 billion by 2032, poised to grow at a compound annual growth rate (CAGR) of 27.9% during the forecast period.

- Software Defined Data Center Market: The global software defined data center market size was estimated at USD 44.77 billion in 2022 and is expected to hit around USD 350.53 billion by 2032, poised to grow at a compound annual growth rate (CAGR) of 22.9%.

- Modular Data Center Market: The global modular data center market size was valued at USD 22.41 billion in 2022 and is projected to hit around USD 112.61 billion by 2032, poised to grow at a CAGR of 17.52%.

- Micro Data Center Market: The global micro data center market size reached USD 5.79 billion in 2023 and is projected to reach USD 74.17 billion by 2033, growing at a CAGR of 29.04% from 2024 to 2033.

- Internet Data Center Market: The global internet data center market size was valued at USD 50 billion in 2023 and is projected to surpass around USD 138.80 billion by 2033, growing at a CAGR of 10.80% from 2024 to 2033.

- Edge Data Center Market: The global edge data center market size reached USD 11.01 billion in 2023 and is projected to surpass around USD 60.01 billion by 2033 with a noteworthy CAGR of 18.48% from 2024 to 2033.

- Cloud Data Center Market: The global cloud data center market size was estimated at USD 26.66 billion in 2023 and is predicted to hit around USD 69.45 billion by 2033 with a CAGR of 10.05% from 2024 to 2033.

- Green Data Center Market: The global green data center market size surpassed USD 60.04 billion in 2023 and is estimated to reach USD 343.06 billion by 2033 with a noteworthy CAGR of 19.4% from 2024 to 2033.

Data Center Market Top Companies

- Equinix, Inc.

- Interxion: A Digital Realty Company

- Oracle Corporation

- Cisco Systems, Inc.

- China Telecom Corporation Limited

- Digital Realty Trust, Inc.

- NTT Ltd.

- Global Switch Ltd.

- Google LLC

- IBM Corporation

- CyrusOne Inc.

- China Unicom (Hong Kong) Limited

- AT&T Inc.

- Amazon Web Services, Inc. (AWS)

- Microsoft Corporation

Data Center Recent News:

- In September 2024, Rustomjee, an Indian property developer, plans to build data centers in Mumbai.

- In September 2024, the Singapore-based CapitaLand Investment intends to invest US$ 1.15 billion to set up data centers in India and reach a capacity of 244 MW by 2028.

- In September 2024, with the goal of becoming carbon-neutral in operations by 2030, ST Telemedia Global Data Centres (STT GDC), a Singapore-based supplier of data center colocation services, unveiled its improved Sustainability-Linked Financing Framework.

The research report categorizes the data center market into the following segments and subsegments:

By Component

- Solution

- Services

By Type

- Colocation

- Hyperscale

- Edge

- Others

By Enterprise Size

- Large Enterprises

- Small & Medium Enterprises (SMEs)

By End User

- BFSI

- IT & Telecom

- Government

- Energy & Utilities

- Others

By Region

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait

Thanks for reading you can also get individual chapter-wise sections or region-wise report versions such as North America, Europe, or Asia Pacific.

Immediate Delivery Available | Buy This Premium Research Report@ https://www.precedenceresearch.com/checkout/3531

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 8044 419 344

Unlocking Market Insights through Data Excellence

The "Precedence Statistics" flexible dashboard is a powerful tool that offers real-time news updates, economic and market forecasts, and customizable reports. It can be configured to support a wide range of analysis styles and strategic planning needs. This tool empowers users to stay informed and make data-driven decisions in various scenarios, making it a valuable asset for businesses and professionals looking to stay ahead in today's dynamic and data-driven world.

To Access our Premium Real-Time Data Intelligence Tool, Visit: http://www.precedencestatistics.com

About Us

Precedence Research is a worldwide market research and consulting organization. We give an unmatched nature of offering to our customers present all around the globe across industry verticals. Precedence Research has expertise in giving deep-dive market insight along with market intelligence to our customers spread crosswise over various undertakings. We are obliged to serve our different client base present over the enterprises of medicinal services, healthcare, innovation, next-gen technologies, semi-conductors, chemicals, automotive, and aerospace & defense, among different ventures present globally.

Web: https://www.precedenceresearch.com

Our Blogs:

https://www.towardshealthcare.com

https://www.towardspackaging.com

https://www.towardsautomotive.com

For Latest Update Follow Us:

© Copyright Globe Newswire, Inc. All rights reserved. The information contained in this news report may not be published, broadcast or otherwise distributed without the prior written authority of Globe Newswire, Inc.